31 January 2015

Richard Epstein

CAPX

Yesterday, the United States Congress passed comprehensive legislation on the Keystone XL Pipeline. That ambitious project is designed to carry over 800,000 barrels along a 1,117 route from Canada to Texas through five other America states. Keystone has been mired in regulatory review in the United States since 2008. The proposed Congressional legislation does two things. First, it will authorize the construction of the long-postponed Keystone XL pipeline. Second it will allow for the export of oil products overseas. Both of these proposals deserve immediate approval by President Obama. Unfortunately, the President has threatened to veto the legislation in order to defend what he regards as “longstanding executive-branch procedures” over foreign relations.

The President’s position illustrates the intellectual disarray of the Keystone opponents on environmental and trade issues.

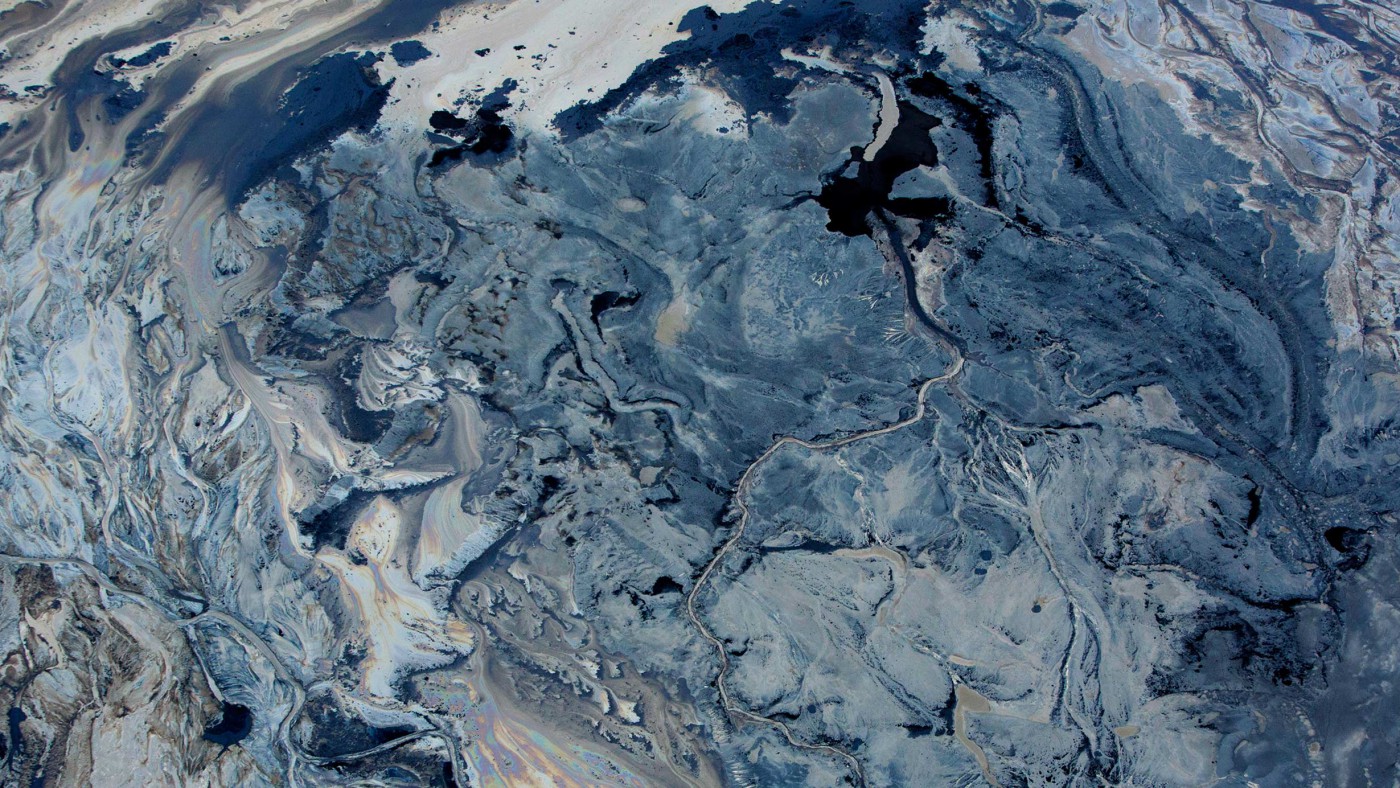

Start with the environmental dimension. Without question, drilling and moving oil carries real risks of environmental pollution. But there is no way to eliminate all pollution risk unless we are all to shiver in our beds. The only responsible strategies are designed to minimize that risk relative to the anticipated gains from reliable and cheap sources of energy. Critics portray Keystone as ‘the continent-spanning death funnel that proposes to bring the world’s worst fossil fuel from the blasted environmental moonscape of northern Alberta to the refineries of Texas and, thence, to the world.’

Sheer hyperbole. Its first illusion is that the Canadian shale oil that will be shipped down to American refineries in the Gulf of Mexico will remain in the ground without Keystone. But rest assured that the Canadians will seek other avenues to market its oil: some will come to the United States through the other expanded pipelines; some will involve oil shipment to distant ports, perhaps in China or in other parts of Asia, and still other shipment by rail in both Canada and the United States. No doubt that this decision does present serious environmental risks in Canada. But these should be addressed by Canadian interests, which bear the direct costs, and not indirectly by the United States, which does not. Worse still, the refusal to ship Canadian crude to the American refiners in the Gulf of Mexico will, as TransCanada points out in response, prolong the dependence on Venezuelan and California crude, both of which emit higher quantities of green house gases than Canadian crudes.

The alternatives to Keystone are, moreover, far from risk free. Pipelines offer controlled and isolated environments that make it far easier to both monitor and control any oil leaks. Shutting down a pipeline for needed repairs does not disrupt the movement of other kinds of goods and services, which is what happens when oil tankers break up at sea or rail cars loaded with oil go off the rails. On net Keystone XL reducesenvironmental risks.

It is, moreover, possible to develop a sound regulatory framework for pipelines to minimize the risks of oil leakage. All too often, modern American environmental law responds to environmental risks with either a ban or an elaborate ad hoc permitting process that takes years to complete. These two risk averse strategies clash with a sounder approach that relies on the combination of damages and injunctive relief long used in both English and American nuisance suits.

The first step delays legal action against possible pollution until the threat is imminent or the pollution actually occurs. The advantage of this strategy is that it spares both the developer and the government the difficult task of tackling all possible obstacles before any useful activity can go forward. It is wrong to claim that endless permitting makes us safer. The more accurate analysis stresses that it is environmentally risky to delay the pipeline, given the fresh losses that stem from the continued use of more dangerous means of transportation.

Stated more generally, any environmental regulatory scheme poses two kinds of error: moving too fast and moving too slow. The President’s insistence on convoluted ad hoc procedures for risk assessment is a complete waste of time and money. The superior approach goes light on initial permitting. It sets out in advance general safety standards to prevent major leaks. Keystone meets any such standards. Compliance is then quickly secured so that both construction and operation can move promptly forward.

This permitting system is far from toothless, for two daggers remain pointed at the heart of any pipeline developer. First, it can be held strictly responsible in damages for the environmental losses that it does cause — which in the Midwest prairie is a tiny fraction of the harm that can result from, say, by deep sea drilling in the Gulf of Mexico. Second, the pipeline can be shut down on a moment’s notice, by legal order if necessary, in the face of actual or impending damages. Some version of this regime is already in place for the thousands of mile of pipeline already in use. There is no reason to deviate from these sound procedures for pipeline management simply because Keystone starts in Canada before entering the United States.

The second great plus of Keystone XL is that it increases the overall capacity of the transportation system by freeing up rail resources for the shipment of other goods, most notably agricultural produce, which of course cannot be shipped through pipes. A sound economic theory encourages these sensible substitutions both within single and across different transportation systems. The reduction of pressure on the rails thus improves their safety as well.

The economic benefits of the pipeline are also clear. In reaching this conclusion, it is important not to make the simple point that Keystone creates jobs, even though that is necessarily the case. The mistake in that claim quite simply is that jobs are created, at least in the short run, by any new expenditures, public or private, regardless of the soundness of the underlying project. But the issue here is not Keynesian pump-priming, which is almost always counterproductive. What is needed is some confidence that the jobs created will be more productive in this capacity than in any other. And for a wide variety of reasons that appears to be the case.

Start with some economic fundamentals. Any increase in overall supply of oil should reduce overall costs, and thus spur other forms of production. Those gains are substantial even though extra supplies of oil could only be sold in the United States. Oil is a global product and the reduction of the demand for imports into the United States will cut the price of oil — now down to about $50 per barrel for premium grades — everywhere in the world.

But the overall situation will improve with the relaxation of US export controls. Great mobility leads to more efficient resource allocation. The same logic applies not just to Keystone all, but to all oil produced or refined in the United States, and the common protectionist mantra for keeping that oil at home are no better than they are for hoarding domestically any other good and service.

Better still, opening up the spigots for overseas sales has huge geopolitical advantages as well, because cheap supplies offer the most attractive strategy for imposing, at no cost to the United States, heavy financial costs on Russia, Venezuela and Iran, who will see their revenue base cut by supplies. Unlike costly systems of sanctions, cheating is just not an issue, because everyone is in search of cheap supplies.

The Congressional proposals therefore are sound on all points. The question is whether President Obama will veto a bill that rightly has widespread support in the United States. He should know that this veto will cost him and his party dearly. Worse still it will set back sensible energy and environmental policies until he is safely out of office. He should wise up and change course and sign the new legislation.

Courtesy of CAPX