Article by Matthew Cranston and Perry Williams, courtesy of The Australian.

Business leaders and economists will demand changes in taxation and planning approvals at Anthony Albanese’s productivity roundtable, but the Prime Minister’s close adviser, former Macquarie chief executive Nicholas Moore, says expectations should be adjusted, with tough decisions on tax unlikely to take priority over housing, energy and education.

Mr Albanese this week said Jim Chalmers would convene a productivity roundtable in August just as the Productivity Commission releases its draft report, the recommendations from which the Treasurer has said would not be fully implemented.

Corporate tax reform, reductions in approval times and red tape, industrial relations changes and the energy transition were named as the key areas needed to kick-start Australia’s lacklustre productivity, which has fallen 1.2 per cent in the past year and is at 60-year lows.

AGL Energy chief executive Damien Nicks told The Australian big business was impatient for change.

“What I want to see now is action taken on driving productivity improvements in Australia,” he said on Wednesday.

The boss of Australia’s largest electricity generator said both politics and business needed to move out of their comfort zones when looking at changes and reform. “We can’t sit here and be comfortable in what we do today,” he said.

“We need to be getting better and more efficient using technology and from a regulatory perspective, we need to look at how we simplify things, particularly in the energy space.”

Big business was sidelined during the 2022 jobs and skills summit dominated by unions, but the AGL chief said the labour issue was only one part of the puzzle.

“When I think about productivity, labour is a big component but it’s also around the technologies to be able to deliver what we’re doing,” Mr Nicks said.

While the roundtable has the potential to give Mr Albanese a launching pad to begin a new era of reform to address growing economic and budget challenges, the focus from business groups and economists has been on tax reform.

AMP’s Shane Oliver said tax had to be considered in any thinking around productivity.

“Among the top three things I think should happen to boost productivity is tax reform to rebalance from relying on personal and corporate income tax to the GST and to index all the income tax thresholds in order to boost incentive and ensure the tax system remains fair across generations,” Dr Oliver said.

Other leading economists including Saul Eslake, EY’s Cherelle Murphy and Outlook Economics Peter Downes are also pushing for tax reform as the most heavy duty way to lift productivity.

“Pillar one of the PC’s five inquiries seeks to encourage business investment through corporate tax reform and we expect this will be a focus of the roundtable,” Ms Murphy said.

“It’s not the root and branch review of the tax system that we’d like, but it’s within the mandate that the government sought and aligned with the Treasurer’s ambition to lift Australia’s productivity growth rate.”

Additionally, economists and sector heads suggested broad-based deregulation and competition policy to remove red and green tape.

Master Builders Australia CEO Denita Wawn said: “If the federal government is serious about productivity, housing must be at the heart of its reform agenda.”

“Master Builders is calling on the federal government to drive co-ordinated planning reform across state and local governments and cut red tape,” she said.

Mr Moore, the former Macquarie chief executive and chairman of the Centre for Independent Studies, said he was encouraged that the government had made productivity the centre of its second-term agenda, but suspected tax reform would not get the same attention as housing and working with states on cutting red tape.

“The Prime Minister has said the emphasis for housing needs to be greater supply. The states and the feds can take a broader view whilst the councils take a narrow view that prevents housing being built in the numbers and types required,” Mr Moore said.

“I am optimistic about what the states can do. I think what we are seeing in NSW in regards to housing, and the government’s policy there, shows that you can get results.

“There is momentum, and the feds should build on that momentum. I think it will happen.”

But when it comes to tax, , Mr Moore said, that was wishful thinking.

“Tax has been on the cards as an issue for 25 years. It’s just a very difficult issue,” he said.

“I think at a roundtable there will be as many different views on tax as there are people in the room.

“The difficulty with tax is that there are fundamental disagreements with what the best policy outcomes are.

“The current debate around the changes for large super balances shows the difficulty of making changes to taxation.”

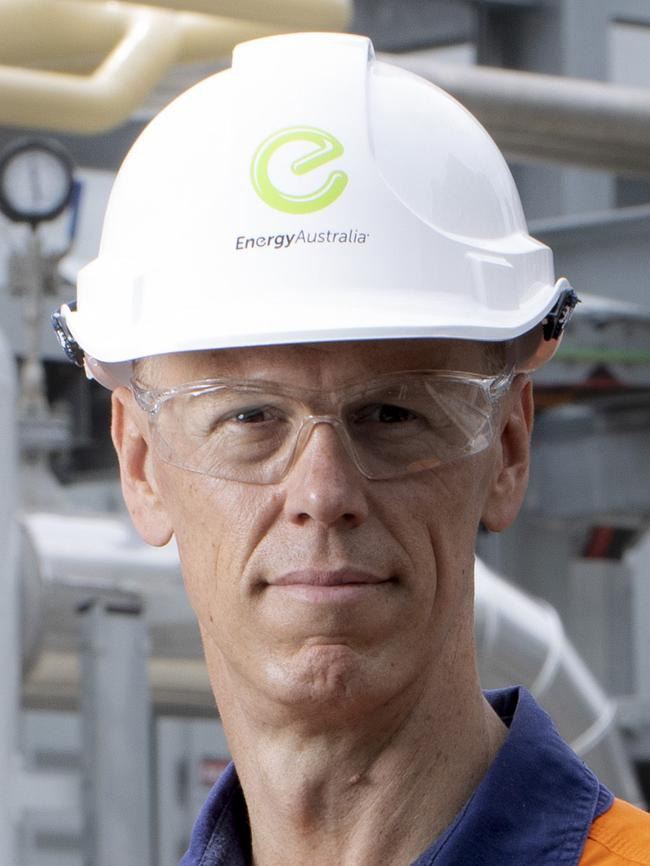

On Wednesday, EnergyAustralia chief executive Mark Collette said the government needed to work with business to make a call on which reforms to pursue.

“The opportunity is to take a lot of ideas which are out there about productivity enhancements and use this as a catalysing mechanism,” Mr Collette told The Australian.

“The Productivity Commission has produced a number of reports over recent years. So I think the ideas are out there but it’s really deciding which ones are going to move the dial.”

The power giant’s CEO said it wanted to also see specific productivity changes that could boost the energy industry and cut bills for households.

“It’s delivering projects more cheaply than the current forecasts predict, and it’s also using energy more efficiently than the current forecasts might predict. I’m interested to see how the summit can help address both those points,” he said.