Native title groups hosting Australia’s iron ore industry are holding more than $1 billion of net assets in trusts, but after 30 years of the native title regime, there is little to show for the vast majority of Indigenous Australians.

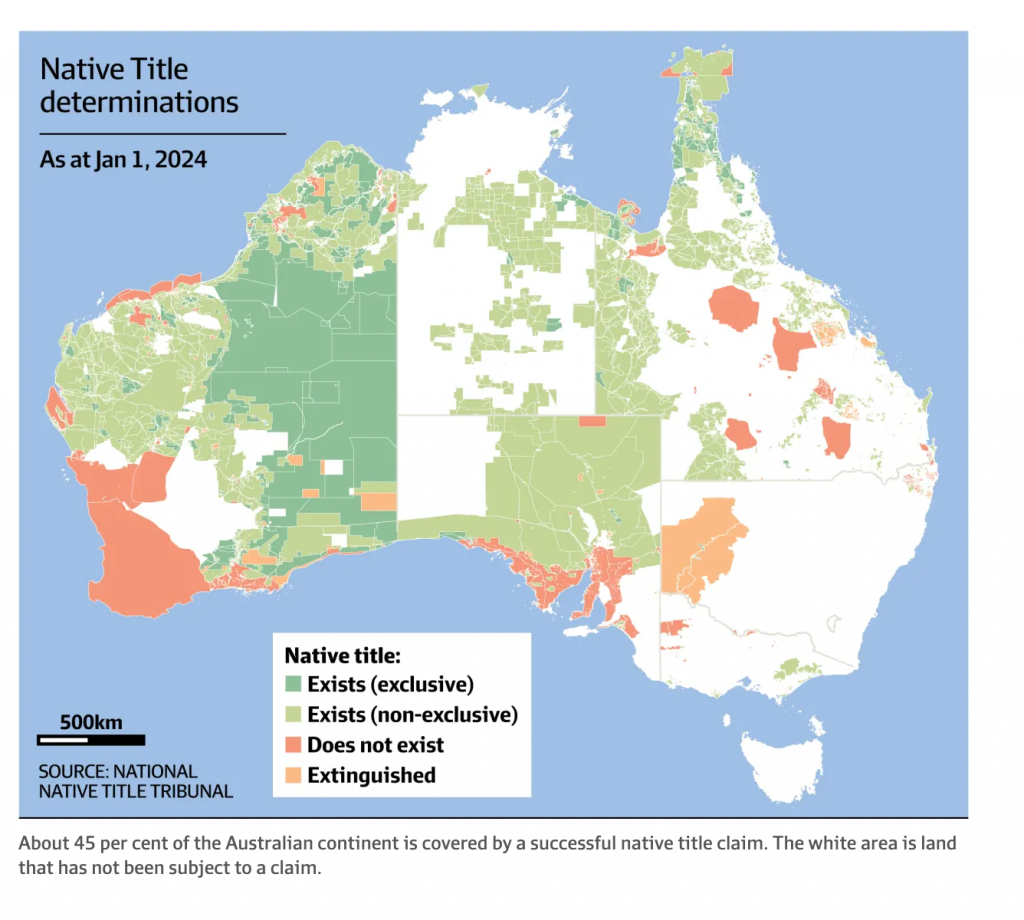

An investigation by The Australian Financial Review finds 45 per cent of Australia’s landmass is now covered by a native title determination and the regime has generated billions of dollars of income for a few groups, particularly those in the nation’s north-west.

Some, such as the Puutu Kunti Kurrama and Pinikura people in the Pilbara iron ore district of Western Australia now hold more than $194 million of net assets in charitable trusts, plus additional funds in discretionary trusts and corporate structures; the equivalent of close to $1 million for each of the group’s 213 members.

But fewer than 9 per cent of Aboriginal and Torres Strait Islander people are members of a native title corporation, and only half of the 268 registered native title corporations reported any income in 2022.

In a series of stories to be published this week, The Australian Financial Review’s examination of years of native title accounts finds a major gap between those who benefit from native title and those who don’t, and reveals how the federal schemes designed to cater for those without native title continue to drastically underperform.

Senior Indigenous leaders are at odds over how best to manage native title money, and the debate comes at a time when the Albanese government is retreating from Indigenous policy reform after the overwhelming defeat of last year’s referendum on a Voice to parliament.

The number of Australians identifying as Indigenous rose by 25 per cent to 812,728 between the 2016 and 2021 censuses, and work to improve their quality of life will increasingly fall to state and territory governments, where a fragmented approach to treaty-making is under way to fill the void created by the federal retreat.

Native title custodians such as Tjiwarl elder Kado Muir says the tangible legacy of the High Court’s 1992 Mabo verdict – which rejected terra nullius, the idea that no one owned the land before European settlement, and triggered the 1993 Native Title Act – far exceeds what the failed Indigenous Voice to parliament could have achieved.

The Tjiwarl people have secured native title over a section of WA near Leinster, about 370km north of Kalgoorlie, where Liontown Resources is building a new lithium mine and where BHP mines nickel.

“We are able to make decisions about what happens on our country, be engaged in commercial relationships with people seeking to extract sunlight, and lithium, ensure we are compensated for the disturbance, and also create opportunities for us to participate,” he told the Financial Review of the legal certainty that native title provided.

“That is the thing I doubt the Voice would have done effectively because there is a disparity between socioeconomic affairs and the political affairs.”

The Tjiwarl people have less than $10 million of net assets in their charitable trust, making them a minnow compared to the six wealthiest native title groups in the Pilbara region who have iron ore mining royalty agreements with Rio Tinto, BHP, Fortescue and Roy Hill.

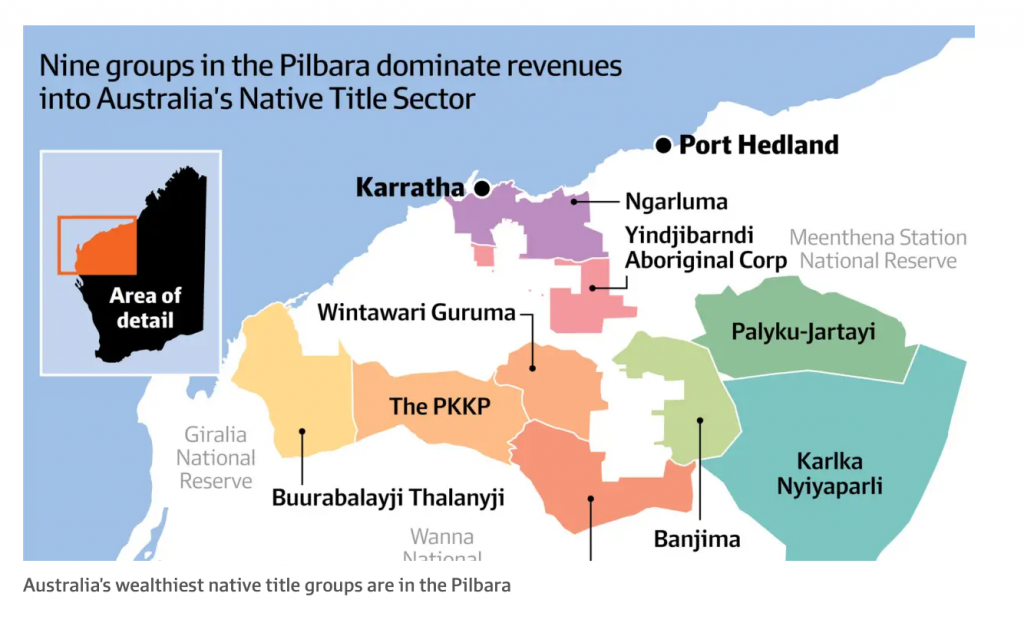

The Pilbara groups

The six wealthiest native title groups in the Pilbara are the PKKP, the Banjima, Yinhawangka, the Eastern Guruma, Nyiyaparli and the Ngarluma, and those six groups collectively have just 2518 members.

The charitable trusts of the big six reported $1.4 billion of collective income over the past decade and distributions to beneficiaries of $555 million.

The big six collectively had $820.5 million of net assets in charitable trusts, which rose to $995.3 million of net assets once the General Gumala Foundation Trust – an entity that stores additional funds for the Banjima, Yinhawangka and Nyiyaparli – was included.

More than $1.07 billion of net assets was held in trusts linked to 13 native title groups in the Pilbara, and those groups have additional funds stored in less transparent discretionary trusts.

The total held in trusts for Indigenous people across WA exceeds $1.3 billion once groups like the Noongar – who achieved land rights over the nation’s south-west via a government settlement – are included.

“The mining on our lands will not last forever, but the destruction and generational cultural, heritage and social consequences will,” says a spokesman for the PKKP, whose ancestral lands include the prized cultural heritage destroyed by Rio at Juukan Gorge in 2020.

Many of the trusts linked to the wealthiest native title groups are in “accumulation” mode; a constitutionally codified state where they hoard the majority of income in “future funds” rather than distribute it to members immediately.

The accumulation strategies are designed to achieve an asset pool of a sustainable size that can eventually replace incomes from mining.

Of the $1.63 billion of income to the charitable trusts of the 10 wealthiest native title groups in the Pilbara over the past decade, approximately $673 million – or about 41 per cent – was distributed to beneficiaries through programs such as subsidised housing, education, health, funerals and even grants for pets.

Trusts are ‘paternalistic’, opaque

Former Western Australian treasurer and now Woodside and Rio Tinto director Ben Wyatt says the trusts are “paternalistic” and it is time to adopt a new approach to managing native title revenue.

“Trusts were created because black fellas weren’t trusted to utilise what was going to be a very significant flow of money appropriately,” says Wyatt, a descendant of the Yamatji people of WA’s Murchison region.

“Those trusts, in my very firm view, now need to be somehow revisited – and this is going to be difficult – to allow a more flexible way for that money to be invested because ultimately, self-determination has to mean something.”

Wyatt, who served as WA’s Aboriginal Affairs minister between 2017 and 2021, says grassroots members of the native title groups should be given more access to the huge asset pools being accumulated in their names.

“Aboriginal groups need to have the opportunity to actually take risks with some of this money, this is the reality of self-determination,” he says. “Some people get a bit anxious about all of this, but the trusts, in my view, are very much a product of their time and no longer appropriate.

”The flow of funds into Aboriginal hands out of those trusts is so small that there is no opportunity to invest, whether it be local projects on country, or broader investments across Australia and the globe that significant investors might want to invest in.

“Often those trust structures are incredibly difficult to navigate and very difficult to see the release of funds, so Aboriginal people as a result have, kind of, been condemned to an inflation-linked outcome, often on hundreds of millions of dollars at a time when there has been huge economic growth.

“They’ve missed out on that [economic growth] because they haven’t been able to utilise this base funding into other forms of investment.”

The accumulation strategies also favour the professional trustee companies that manage the trusts on behalf of native titleholders because the fees charged by those trustee companies are often linked to the quantum of assets in the trusts.

Communities defend use of trusts

But native title groups reject the notion that grassroots members find it difficult to access native title money.

A spokesman for the PKKP – whose assets held in charitable trust have more than doubled since 2017 – says the organisation is trying to balance immediate needs such as housing with the desire to create an “intergenerational legacy”.

“The corporation has a transparent trust management structure actively controlled by PKKP members which has been developed by the community at its grassroots level,” he says.

“The trust has an independent trustee to ensure the proper management of all funds. These funds are used to address immediate needs such as food, health, housing and household requirements.

“We are also creating an intergenerational legacy focusing on initiatives such as education and training opportunities, financial independence, building capability and capacity, preservation, and an increased voice over PKKP heritage, culture and land, and advocacy to help challenge the barriers faced by Traditional Owners.

“As a form of community empowerment and self-determination, it is the right of the community to determine where those funds are spent.”

In 2001, the Eastern Guruma people decided to funnel royalties earned from Rio Tinto into a charitable trust that has recently hoarded a large proportion of income generated. Net assets in the trust rose from $7 million to $137.3 million between 2013 and 2023.

The trust earned $54.3 million of net income in 2023 and made distributions to beneficiaries of just over $24 million. Distributions over the past decade represented about 36 per cent of income.

“Monies are paid to beneficiaries from the charitable trust to start small business, including the purchase of equipment, continue education and personal professional development, consume private health care, and housing,” says a spokesman for the Eastern Guruma’s native title corporation, Wintawari Guruma.

“These allocations to beneficiaries all contribute to individuals improving their life chances.”

The Eastern Guruma’s charitable trust owns 45 investment properties worth more than $25.6 million, and many of those properties are provided rent-free to beneficiaries of the trust.

In 2009, the Eastern Guruma decided royalties earned from iron ore miner Fortescue would flow into a less transparent discretionary, or “direct benefits” trust, rather than a charitable trust.

The Wintawari Guruma spokesman declined to disclose the value of assets held in the direct benefits trust, but said it was less than the charitable trust, and full disclosure was provided to members of the native title group.

He says the direct benefits trust did not accumulate funds, and 100 per cent of money paid into the trust each year was distributed to members. Distributions to members from the direct benefits trust in 2022-23 totalled $5.2 million.

Other native title groups in the Pilbara with millions of dollars of assets held in trust include the Palyku-Jartayi, the Yindjibarndi, the Kariyarra, Ngarlawangga, Nyangumarta and the Thalanyji.

The focus on trusts comes after the Supreme Court of South Australia last year ruled that grassroots members of the Adnyamathanha native title group had the right to access the financial records of a trust holding money earned from a uranium mine on ancestral lands.

The Adnyamathanha money was held in an opaque private discretionary trust, and the court found the beneficiaries were entitled to inspect its records.

The Supreme Court ruling has been challenged by the trust operator, Rangelea Holdings.

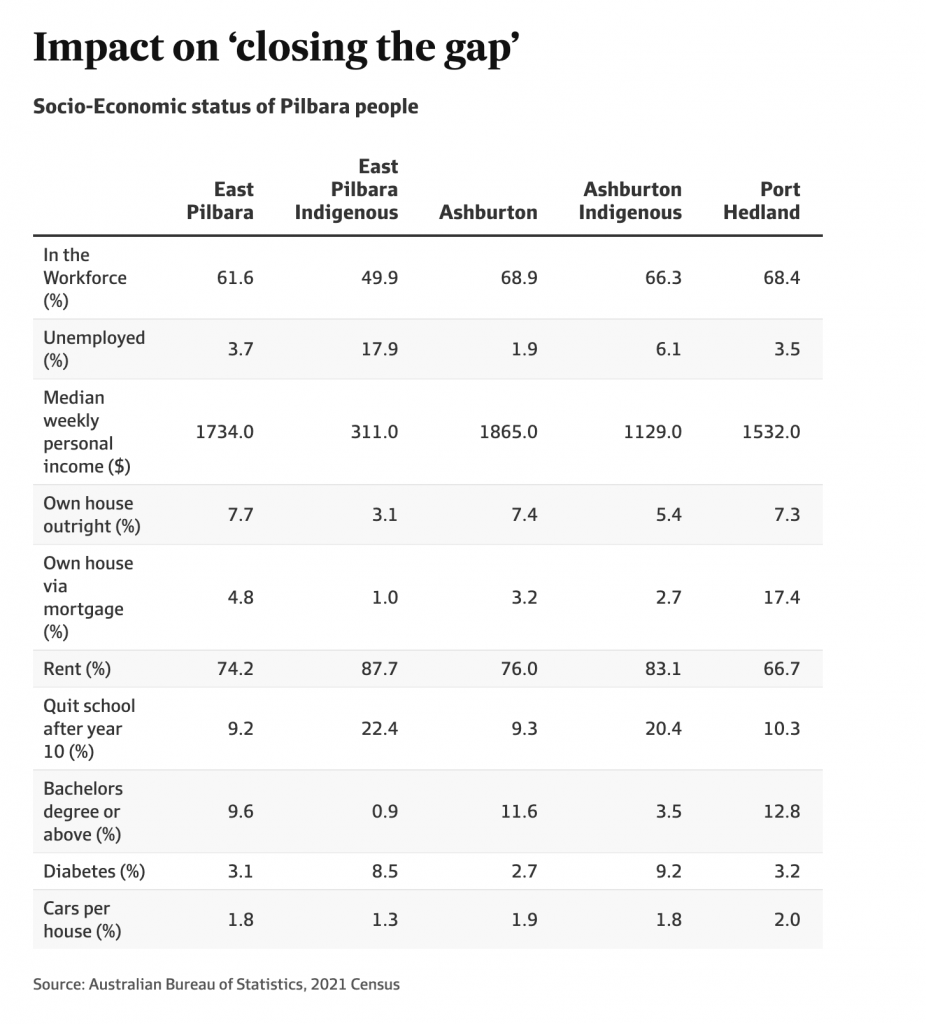

The federal government’s “closing the gap” initiative is on track to deliver just four of the 19 targets set for 2030, but Australian Bureau of Statistics data from the 2021 census suggests Indigenous people living close to the wealthiest native title groups in the Pilbara had a higher socioeconomic status than Indigenous people in other parts of the nation.

Indigenous people in West Pilbara local government areas like Ashburton Shire, Karratha Shire and Port Hedland Shire reported higher weekly median wages than the Australian average, and close to double the national average for Indigenous people.

Those three shires broadly correlate with the ancestral lands of the Yindjibarndi, PKKP, Ngarluma, Thalanyji and the Eastern Guruma people.

But the socioeconomic status of Indigenous people in the East Pilbara, which roughly correlates to the native title lands of the Nyiyaparli and the Palyku-Jartayi, is below the national average for both Indigenous Australians and all Australians.

Comparing the native title territories with local government areas is an imperfect science; members of native title groups do not necessarily live within their legally determined native title area. For example, 137 of the 428 members of the Nyiyaparli native title group live in Port Hedland and South Hedland; about 400 kilometres north of the native title area.

The Nyiyaparli have 61 members living in Perth and 33 in Queensland, and most native title groups have a similar spread of members around the continent.

Between 70 per cent and 88 per cent of Indigenous people in the Pilbara live in rental accommodation; well above the national average of 30.6 per cent.

While it has delegated treaty-making to states and territories, the Albanese government has vowed to act on Indigenous housing by building 270 new homes each year for a decade at a cost of $4 billion.

New trusts being created

The trend for Indigenous groups to hoard the majority of their income in trusts rather than swiftly distribute it into their communities looks set to continue, based on moves by the Murujuga Aboriginal Corporation to set up a new charitable trust in February.

The new trust will hold monies the Murujuga expect to receive from companies such as Woodside, Rio Tinto and Yara Pilbara which operate on the Burrup Peninsula.

The new trust is constitutionally required to accumulate funds with the aim of creating a “capital base” that can be maintained “in perpetuity, where only a percentage of the net income and a small percentage of the capital is available for distribution each financial year”.

Distributions from the Murujuga Trust will be limited to 2 per cent of the capital base in any given year and 50 per cent of annual net income.

Once the Murujuga trust reaches its capital target and relaxes the accumulation strategy, the constitution states the capital base must continue to be increased by at least the consumer price index each year.

Murujuga Aboriginal Corporation chief executive Kim Wood says the organisation wants the trust to create a capital pool that will provide for traditional owners long after the big gas and mining giants have extracted the last of their resources out of the Burrup Peninsula.

“Industry will have a finite timeline, whether it is the gas industry or iron ore, urea or hydrogen industries that are either here, or emerging here on the Burrup,” he says.

“Our intent is to ensure there is a trust there to provide funds long term, so the organisation can continue for generations to come. There is an independent trustee that will determine whether requests for funds suit the objectives of the trust, so it has been set up completely at arms length from us with a very reputable trustee.”

ASX-listed Equity Trustees manages more than 20 native title trusts and will be the trustee for the new Murujuga trust.

A spokeswoman for Equity Trustees says accumulation strategies are typically sought by native title groups or their stakeholders and were not forced upon native title groups by trustees.

“Trustees are not usually involved in the negotiation of group agreements with third parties – usually external law firms prepare trust deeds with accumulation requirements or allowances in consultation with the representative corporations,” she says.