Article by Matthew Cranston and Jack Quail, courtesy of The Australian

29.05.2025

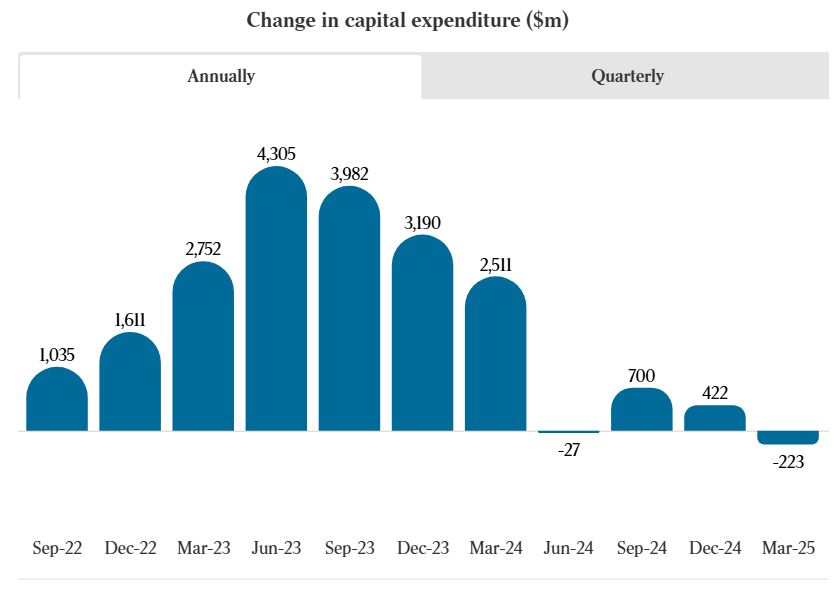

Jim Chalmers’ hopes of a recovery in the business sector have been dealt a blow after private capital expenditure recorded its biggest annual contraction since 2020, shocking economists, dampening future investment plans, denting next week’s GDP numbers and drawing calls from chief executives that policy is becoming anti-business.

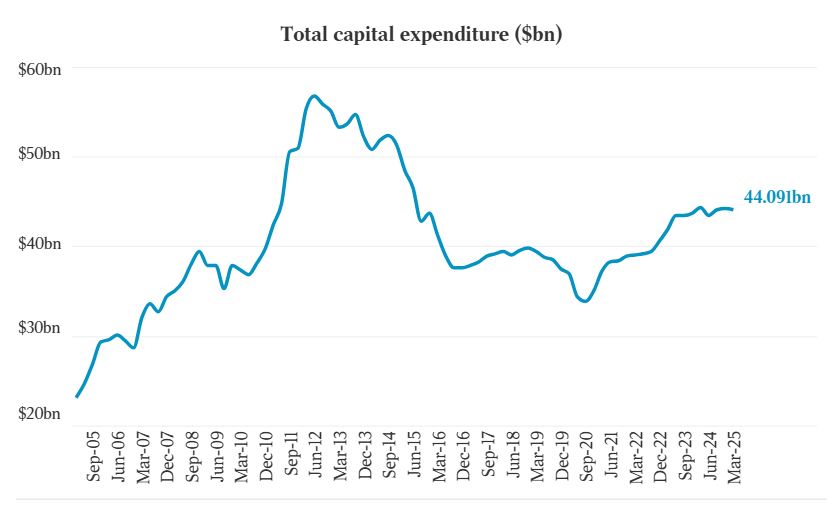

Even before the Trump administration announced worldwide tariffs in April, private capital expenditure nationwide slipped 0.1 per cent in the three months to March, below economists expectations for a 0.5 per cent lift, and dropped 5.3 per cent in Victoria. Non-mining investment is down 1.6 per cent over the last year.

Estimates for investment, while traditonally revised up each financial year, are now leaning towards a downgrade, while economists have trimmed their GDP forecasts and business leaders and industry groups are sounding the alarm.

The Treasurer has been urging business to spearhead a private sector-led recovery, saying it would ultimately fall to them to help lift Australia from its current growth slump. “We acknowledge that as growth recovers in our economy the best kind of growth is private sector-led growth,” Dr Chalmers said late last year.

The Treasurer has overseen a surge in government spending in recent quarters, with the public sector now amounting to a record share of the economy – a shift that is squeezing out private-sector activity and fuelling inflation.

“For the time being, growth is especially weak and public final demand is playing a helpful role, but we don’t expect that to be a permanent feature of the Australian economy going forward,” he said at the time.

Private capital expenditure is now 0.5 per cent lower than a year ago, sending a distress signal to Dr Chalmers that his expectations for a business recovery are not coming to fruition and that his refusal to make business allowances and tax breaks permanent, combined with high energy and labour unit costs and heightened uncertainty from Donald Trump’s trade war, have only softened investment intentions.

Both Treasury and the RBA expect business investment, which includes both private capital expenditure and construction work, to continue to grow over the next three financial years, albeit more modestly than over the last two years after reaching a decade high.

The chairman of Australia’s third largest company, CSL’s Brian McNamee, said the poor business investment figures were a result of weak government policies. “This data reflects a quiet business withdrawal of investment dollars,” he said.

“There are no threats, no shouting … just an accumulation of hostile policies and government crowding out of enterprise. Investment dollars will find homes elsewhere that are more welcoming and reward risk-taking. Who could blame business or individuals in this environment for either sitting on their hands or investing elsewhere?”

Mr McNamee, who has been a strong opponent of Dr Chalmers unrealised capital gains tax, mentioned that policy as one of the “final straws” from the Labor government’s anti-business policies. He said the situation had got to the point where other business leaders now needed to speak out.

New opposition Treasury spokesman Ted O’Brien called on Dr Chalmers to address Australia’s poor productivity with policies that encouraged investment.

“This doesn’t bode well for Australian manufacturing in particular, which is struggling as a direct consequence of Labor’s approach to energy, industrial relations, regulation and red tape,” Mr O’Brien said.

“If the Treasurer is serious about trying to reverse the trend of declining productivity under his watch, he needs to start pulling economic levers which encourages investment not repels it.”

Business Council chief executive Bran Black said he had specifically called for an investment allowance that would give businesses incentive to reinvest and become more productive but that was knocked back. “This slowdown in business investment is not what we want to see because strong, sustained investment is critical to lifting productivity and delivering higher wages over the long term,” he said. “We want to work closely with government to create the right conditions for businesses to invest, grow, and innovate because that’s how we build a more productive and resilient economy.”

The latest numbers show the annual rate of non-mining business investment is -1.6 per cent.

Non-mining equipment and machinery capex fell again this quarter due to a 17.9 per cent drop in the information media and telecommunications industry. Businesses invested less in IT infrastructure, pushing down investment in labour-intensive professional, scientific and technical services by 7.9 per cent, and finance and insurance by 9.2 per cent.

Australian Chamber of Commerce and Industry chief executive Andrew McKellar said extension of environmental approval for Woodside’s North West Shelf to operate for another 40 years, was a good signal to business, but more needed to be done to encourage private sector and prevent bigger government.

“The level of public expenditure does have an impact that only leads to a situation where taxes have to go up to pay for more expenditure,” Mr McKellar said. “The private sector needs to be in the lead but you can’t make business invest if it’s in an area where it’s not profitable. I think the latest results go straight to the issue of Australia’s competitiveness. We see private investment as absolutely central to the challenges the economy faces.”

In a bid to reverse the dour outlook for business investment, industry groups have urged the federal government to establish an economy-wide tax break to allow firms to deduct spending on machinery, plant and equipment. Labor rejected the proposal, choosing instead to extend its existing instant asset write-off by just 12 months — a move that sparked frustration among business leaders who need certainty.