Article by Ayman Falak Medina courtesy of ASEAN Briefing.

For foreign investors, entering Indonesia’s special economic zones (SEZ) and taking full advantage of what they offer requires a long-term outlook. Companies must first ensure their industry is suited to the infrastructure and benefits afforded in the SEZs and understand the long-term domestic and regional policies that could impact their industry.

A priority policy

Indonesia’s government has made the development of the country’s special economic zones (SEZ) a priority policy with the aim of attracting over US$50 billion in foreign investment over the next decade, particularly for SEZ-oriented manufacturing.

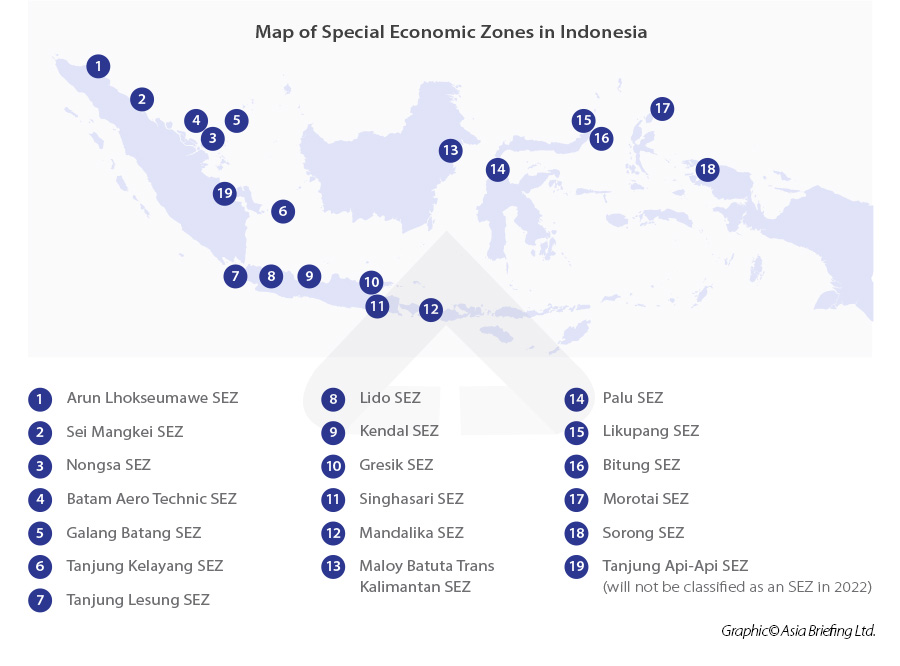

As of 2022, there are 19 SEZs of which 12 are in operation and the remainder are in the construction phase. Eight are designated for tourism with the rest for manufacturing and processing.

The concept of SEZs in Indonesia was only announced in 2014 when President Joko Widodo came to power. Buoyed by the success of the country’s free trade zones, SEZs were developed to increase foreign investments into the country further. As such, the first SEZs in Indonesia has only been in operation since 2015, with the majority only beginning operations in 2019.

Indonesia’s SEZs have been designed to maximize the surrounding resources. Companies looking to incorporate into the country’s SEZs must select their location strategically based on the available infrastructure and natural resources, particularly since most of the country’s SEZs only began operations in 2019.

Moreover, foreign investors need to be aware of the Indonesian government’s development plans, which often determine which industries receive the most support and incentives. In establishing the SEZs, the government has sought to diversify away from the island of Java and spread across the country. As of 2021, Indonesia’s SEZs have attracted just over US$5 billion in investments and employed over 28,000 workers.

Having this long-term outlook will allow foreign businesses to be rewarded by Indonesia’s unique advantages, such as its competitive labor costs, huge domestic market, and the potential expansion of land in the SEZs – an issue that has constrained businesses in other ASEAN markets like Malaysia and Singapore.

We highlight some of the specializations of Indonesia’s SEZs below.

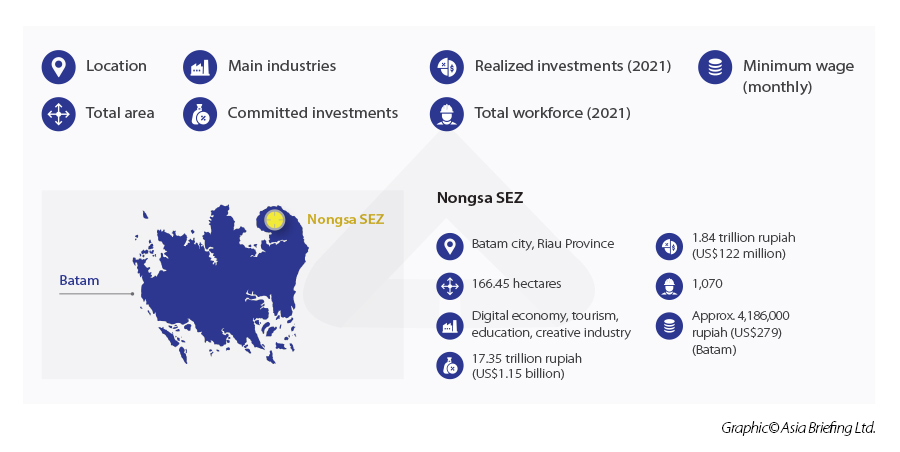

Nongsa SEZ

Indonesia is set to open two new SEZs on Batam after President Joko Widodo recently approved the decision, which includes the Nongsa Digital Park. The digital park will focus on research and development, education, and creative industries, along with its existing focus on technology and tourism. The park originally opened in 2018 after bilateral discussions between Indonesia and Singapore to develop an ‘IT hub and digital bridge’ between the two countries. Currently, the park’s 155.43 hectares of land is home to over 100 technology companies, mostly from Singapore.

As an SEZ, the park aims to attract more international investors, beyond the largely Singapore-based contingent currently active in the area. Its goal is to receive 16 trillion rupiah (US$1.1 billion) in investments and to create 16,500 new jobs. To reach this target, the park hopes to become a hub for data centers, an industry the market research firm Technavio projects will grow by US$10.57 billion between 2019 and 2023 in Southeast Asia.

Webinar – Diversify Your Business to Indonesia – The Ins and Outs of Set Up

5:00 PM China Time / 4:00 PM Vietnam / 10:00 AM CET

Oct. 20, 2022 | 10:00 AM Los Angeles / 1:00 PM New York

Discover why, where, and how to set up in Indonesia, as well as what type of investment is permitted along with taxes and other costs involved with operating a business in Indonesia.

Join us in this free webinar!

The park will be at the forefront of Indonesia’s booming digital economy, which according to a report by Google, Temasek, and Bain & Company, will have a gross merchandise value (GMV) of US$146 billion by 2025 – the largest in ASEAN. This growth will be primarily driven by e-commerce, which is expected to have a GMV of US$104 billion by the same year.

The island of Batam has been a free trade zone since 2009, along with the neighboring Bintan and Karimun islands, and its first SEZs were set up in 2017. Together, the three islands are known as the BBK free trade zone.

Due to its proximity to Singapore (only 20km away), some 70 percent of Batam’s foreign investors are from Singapore, who use the island as an alternative manufacturing hub. According to the Badan Pengusahaan Batam (BP Batam), the local investment and development authority, Singaporean companies have contributed some 42 percent of the US$2.5 billion of foreign investment that Batam has received between 2015 to 2020. The island produces goods ranging from computer chips to precast concrete and is home to multinational companies such as Caterpillar, Ciba Vision, and Schneider Electric.

Batam Aero Technic SEZ

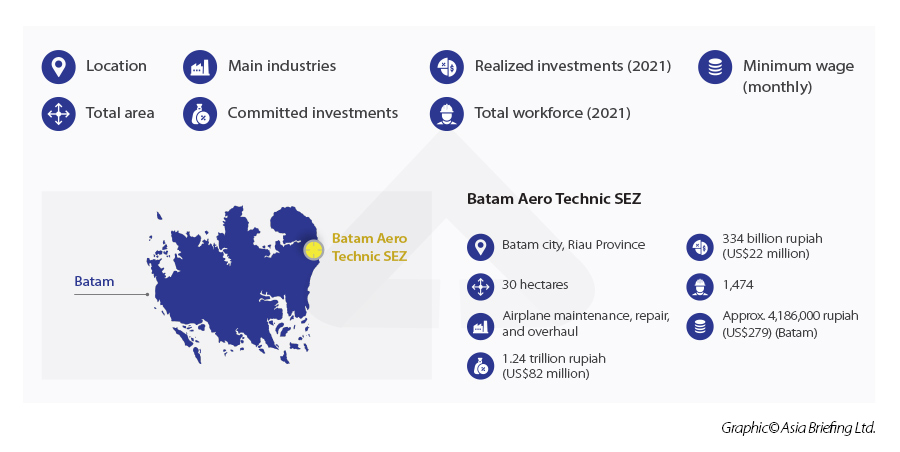

Batam Aero Technic (BAT) is the other new SEZ declared by President Joko Widodo alongside the Nongso Digital Park. With the upgraded SEZ status, Batam Aero Technic plans to expand from maintenance, repair, and overhaul (MRO) of passenger aircraft to logistics and distribution, production and processing, and technology development.

BAT hopes to capture the US$1 billion that local airlines spend on MRO and the US$100 billion that airlines in the Asia pacific will spend by 2025.

Other supporting industries currently being developed in the SEZ are in the form of logistics, such as the warehousing of equipment and components. Further, BAT aims to manufacture cabin items from head racks to galleys, airplane lavatories, airplane seats, carpets, and head rests.

The 30-hectare facility is owned by Lion Air Group, the holding company that owns Indonesia’s largest private airline, Lion Air. In 2013, the airline made the largest-ever single order of Airbus A320 planes at 234, valued at US$22.4 billion.

Batam Aero Technic aims to receive 7.2 trillion rupiah (US$500 million) in investments and to create close to 10,000 new jobs with the upgrade to SEZ status. Indonesia is the second-fastest-growing aviation industry in the world after China, and the country’s air passenger market is expected to become the fourth largest in the world by 2039.

Sei Mangkei SEZ

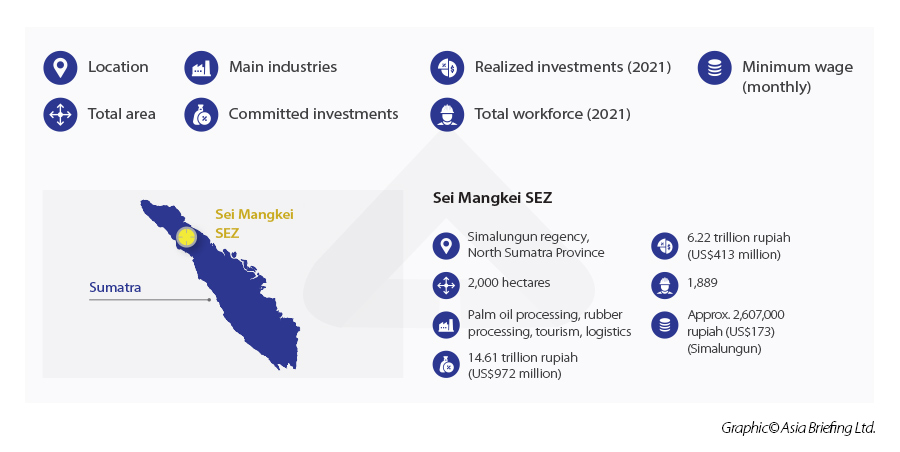

Sei Mangkei SEZ has exported over 26 trillion rupiah (US$1.7 billion) worth of goods since its establishment in 2015, mainly for palm oil and palm oil products. The North Sumatra Province is one of the leading palm oil-producing regions in the country.

PT Unilever Oleochemical Indonesia (PT UOI) – a subsidiary of multinational consumer goods company Unilever — is the largest tenant in Sei Mangkei SEZ with the company operating on 27 hectares of land, producing a variety of by-products of palm oil refining, such as soap noodles, surfactants, fatty acids, and glycerin, which are raw materials needed for household goods like detergents. The company also invested a further US$150 million in 2021 to expand its operations in the SEZ, and once completed, PT UOI will have the largest palm oil processing facility in Sei Mangkei SEZ. Further, Sei Mangkei aims to have the largest integrated facility for palm oil processing.

Palm oil is by far the most consumed and traded edible oil in the world. According to the United States Department of Agriculture, 77 million tons of palm oil are expected to be produced this year – with Indonesia accounting for around 60 percent of the global supply share. Malaysia ranks second with a 25 percent supply share.

Grown only in the tropics, the oil palm tree produces a high-quality oil that is used as a common ingredient in cosmetic and household items, such as detergents, margarine, soaps, chocolates, cakes, cleaning products, and biofuels, among others.

The Indonesian government is also planning to develop a railway from the Sei Mangkei SEZ to Kuala Tanjung port. Currently, trucks from the SEZ transport goods to the port some 50km or so by road. The port has a current capacity of 600,000 twenty-foot-equivalents (TEUs) but this is expected to be upgraded to handle over 12 million TEUs by 2039.

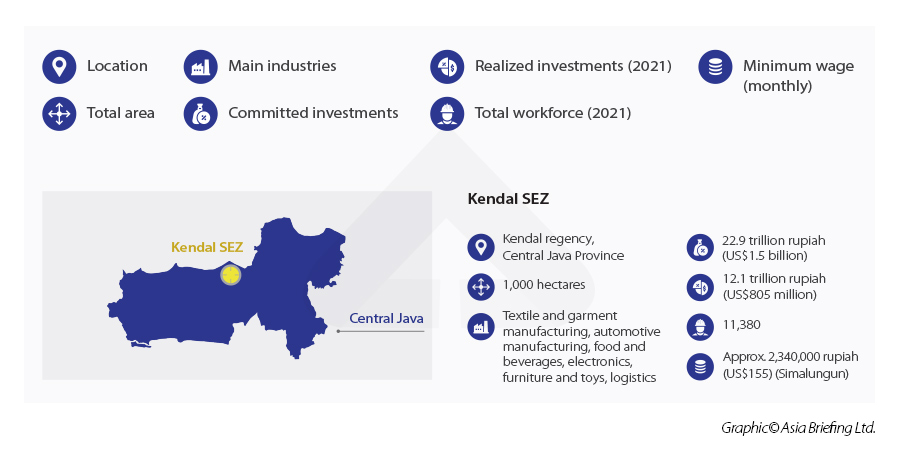

Kendal SEZ

The Kendal SEZ was only given SEZ status in 2019 but has managed to attract over 70 businesses from Indonesia, Singapore, Malaysia, Japan, South Korea, and China.

Before being upgraded as an SEZ, Kendal was an industrial park; in fact, it is the only industrial park on Java island that has been given SEZ status.

The Kendal SEZ is designated for export-oriented manufacturing ranging from automotives to electronics to textiles and fashion. Out of the 66 tenants that have been established in the Kendal SEZ, 16 are fully operational with the remaining in the construction phase. PT MasterKidz Indonesia, a subsidiary of Hong Kong toy manufacturer MasterKidz, is one of those in full operations and has committed to invest over 400 billion rupiah (US$26.5 million), one of the largest investments in the SEZ. Another company, textile manufacturer, Dae Young Textile, has committed to invest 81 billion rupiah (US$5.3 million). Meanwhile, PT Sasakura Indonesia, a joint venture between Japanese engineering firm Sasakura Engineering Co., Ltd. and Indonesian engineering firm PT Wasamitra Engineering, has committed to invest 350 billion rupiah (US$23.2 million) to engage in steel fabrication activities.

The government has projected that the Kendal SEZ will attract 72 trillion rupiah (US$4.7 billion) by 2025, employing a workforce of 20,000 people.

Central Java Province is being pushed as one of Indonesia’s manufacturing hubs. 30 percent of the country’s manufacturing activities are already located in this province, mainly for labor-intensive industries, such as textile production, attracting some of the largest apparel companies in the world like Nike, Uniqlo, and Adidas. The province saw US$980 million in foreign investments between January and September 2021.

As wages continue to increase in Jakarta, a growing number of foreign businesses see the opportunity to tap into the more cost-effective workforce in Central Java, which has a population of 34 million – larger than the whole of Malaysia — and a provincial minimum wage of US$119 per month. The province is also supported by 11 seaports, four international airports, and more than six industrial estates.