Article by Alex Irwin-Hunt, courtesy of fDi Intelligence.

10 September 2025

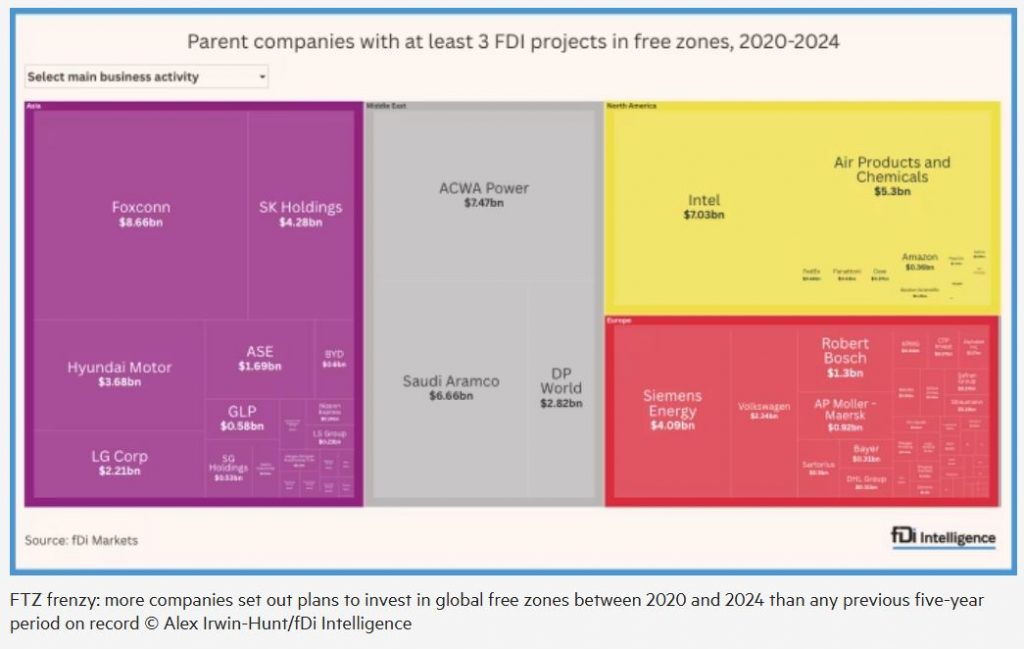

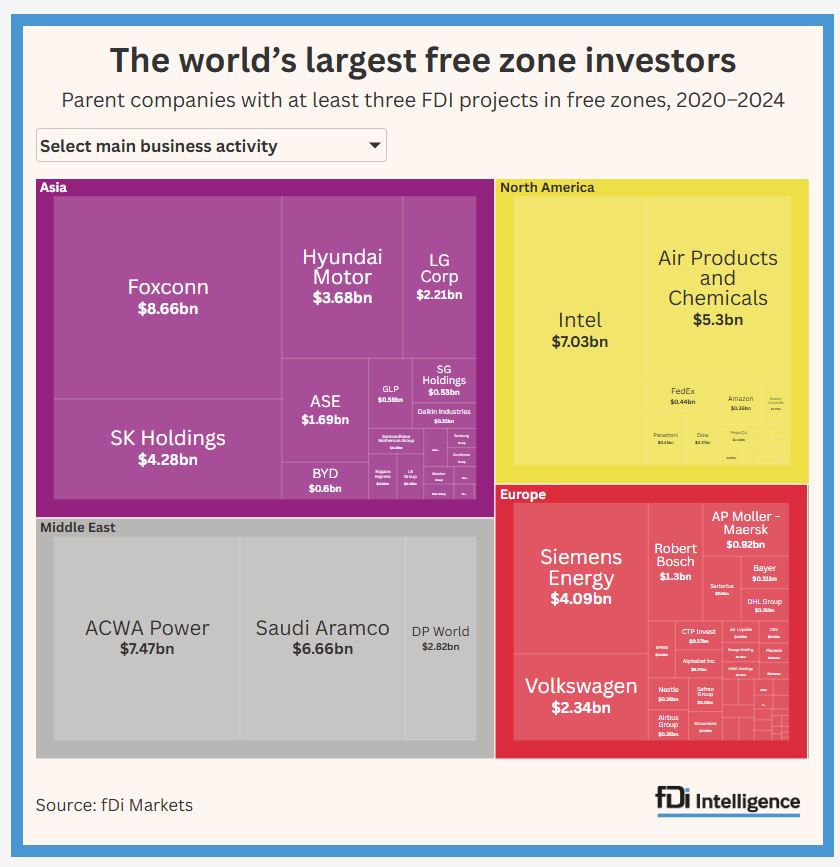

Multinationals based in Asia and the Middle East have committed the most capital to global free trade zones in the past five years, holding six of the top 10 spots among major free zone foreign direct investors.

Between 2020 and 2024, 88 parent companies announced at least three FDI projects in FTZs, according to fDi Markets, which tracks greenfield investment commitments. A threshold of three FDI projects was used to exclude single speculative investments in sectors like green hydrogen.

Almost $69bn was pledged to 342 FDI projects in free zones by these 88 companies in the five-year period. A third ($24bn) of this capital expenditure was announced by Asia-based investors. The majority of this was down to large electronics firms like Taiwan’s Foxconn, South Korea’s LG Corporation and Seoul-based automaker Hyundai.

Middle Eastern investors, based in Saudi Arabia and the UAE, accounted for a quarter ($17bn) of total capital spending plans since 2020. The bulk of this came from 19 FDI projects by three companies — Dubai-based logistics company DP World and Saudi energy firms Aramco and ACWA Power.

Investors from Europe and North America accounted for a larger share of the 342 projects, respectively representing 45 and 24 per cent. But their overall capital spending was lower than their Asian and Gulf counterparts, reflecting a greater frequency of smaller FDI projects.

Nonetheless, major companies from either side of the Atlantic have chosen FTZs for their expansion plans since 2020. US chipmaker Intel and chemicals conglomerate Air Products have collectively pledged billions of dollars to FTZ projects. German companies such as Siemens Energy, carmaker Volkswagen and engineering firm Robert Bosch have also been among the most active FTZ investors in the past five years.

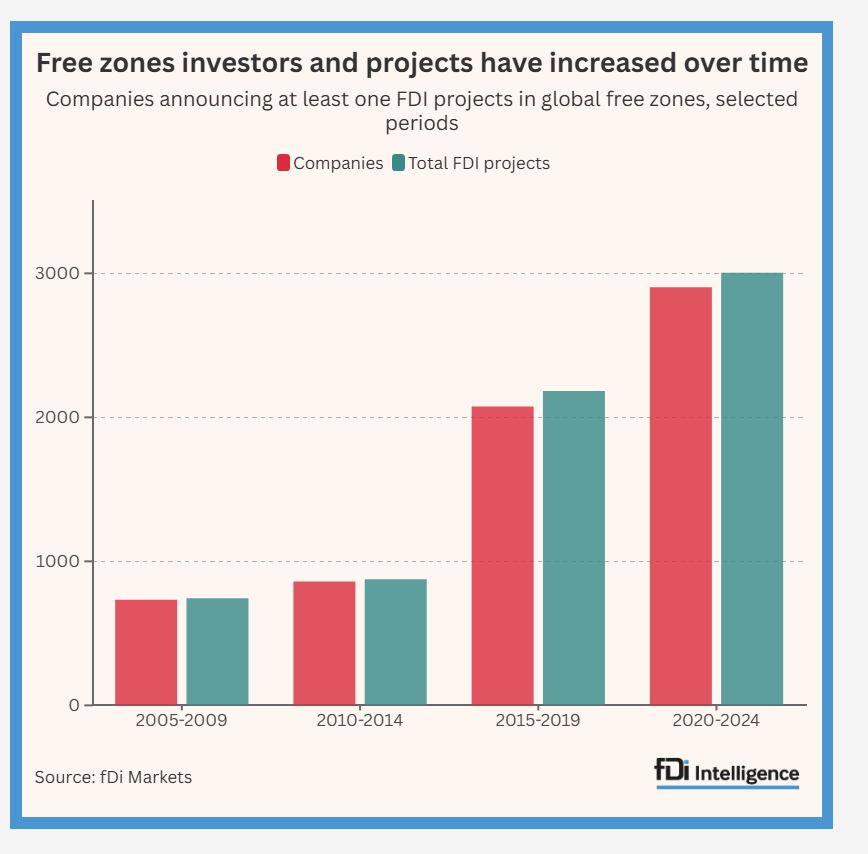

Multinationals have expanded their international footprint in free zones since the Covid-19 pandemic disrupted global supply chains. Growing investor interest in FTZs follows a rise in geopolitical tensions, protectionist policies and fragmentation in the global economy.

Data from fDi Markets shows that more than 2,500 companies announced at least one FDI project in 630 free zones across the world between 2020 and 2024. This was up from about 1,700 parent companies that pledged to invest in 660 free zones outside of their home market in the five years before the Covid-19 pandemic. This reflects FTZs’ greater appeal and a growing number of FTZ options, as governments establish zones as tools for promoting investment, exports and economic development.

Close watchers of investment trends have heralded a new era for international expansion. “This next phase of globalisation is more complex and challenging,” wrote John Waldron, Goldman Sachs’ president and chief operating officer in a recent Financial Times article.

“Multinationals that previously focused on efficiency now centre their strategy on resilience and diversification. Companies are increasingly paying for the insurance policy of availability and scalability of supply, prioritising security over cost,” he wrote.

As companies manage frenetic policy shifts, a reshaping of the global trade system and higher operating costs, FTZs are proving popular to maintain business operations and seek new growth avenues.